Our results-driven fintech marketing agency supports financial technology brands with their quickest expansions.

Fintech digital marketing agency prioritises targeting the right users, creating high-intent leads, and aiding global growth with smart, data-driven digital strategies.

FinTech marketing is a specialized branch of digital marketing that focuses on driving awareness, trust, and conversions for financial technology companies. From payments and lending platforms to investment tools and wealth management solutions, FinTech marketing services help financial tech brands navigate the complexities of highly regulated environments and effectively reach their target audiences.

FinTech brands don’t grow on autopilot, but on research-driven strategies

Facing the challenges of high acquisition costs and lack of customer trust? Experience 100% scalable growth. Partner with an experienced fintech digital agency offering data-backed fintech advertising services.

Beat super expensive and competitive keywords with the support of a fintech marketing agency. Enjoy top-notch optimization for ROI.

Compliance and authority let users build trust in a fintech marketing firm. Brand credibility is 100% needed to let clients share their financial data.

The long decision cycles need multitouch nurturing and CRO by a marketing agency for fintech.

Fintech seo competition and compliance barriers result in delayed organic growth. Overcome that with the help of a fintech seo agency.

Poor tracking results in bad decisions, affecting growth and ROI. Only a top fintech digital marketing firm with a research-team guarantees you quality leads.

Stay updated with the strict financial advertising regulations with regular updates and information from a leading fintech marketing agency.

PPCROY’s tailored digital marketing for fintech companies promote growth, brand awareness, and compliance for various businesses, both large and small.

As a marketing agency specializing in fintech, we guide you on driving growth through lead generation, conversion optimization, and performance marketing.

FinTech Marketing Services

Average ROI for Clients

Healthcare Practices

Establish organic presence and credibility for long-term acquisition.

Seize high-intent requirements with conformed paid acquisition by our top-notch fintech PPC agency successfully delivering fintech seo services.

Educate users and facilitate conversion with the help of a fintech content marketing agency!

Transform leads into customers with convincing and conversion driven fintech email marketing.

Establish power and trust in online platforms with fintech social media marketing.

Foreseeable pipes constructed on CRO and attribution for fintech lead generation.

Struggling to find the right marketing fit? Our team of Fintech marketing consultants crafts a custom digital marketing strategy for fintech, tailored to your specialand growth goals!

As a healthcare seo expert, delivering consistent results is the key.

Our patient acquisition models are based on people searching, comparing, and booking healthcare services. These solutions integrate digital marketing to healthcare, patient intent, adherence, and quantifiable growth, an aspect that would ensure your practice is attracting the right patients at the right time efficiently.

Patients, while choosing a primary care provider, seek local convenience, accepted insurance plans, and same-day appointments.

The privacy of all touchpoints is guaranteed with HIPAA-compliant forms and secure data management of patients.

Primary care practices are able to find and attract high-intent patients and transform visits into scheduled appointments through healthcare SEO services and local SEO, as well as call tracking.

Trust, safety, parent testimonials, and child-friendly services are some of the factors that can affect parents when choosing pediatric care.

Every sensitive information is safeguarded by strict child privacy regulations and processes that are in accordance with HIPAA.

The digital marketing healthcare agency strategies of combining content marketing, review management, and reputation building work out in pediatric clinics to attract and retain patients.

The patients are focusing on proximity, real-time wait time, and walk-in services as part of the urgent care requirements.

Legal and ethical marketing is achieved through emergency disclaimers and message compliance-awareness.

The urgent care centers will attract patients who are willing to book as soon as possible through healthcare PPC agency campaigns, Google Maps optimization, and location-targeted advertising.

Patients pursue providers who demonstrate a level of expertise, results of their treatment, and specialization in their medical requirements.

Trust and compliance are achieved through the provision of accurate medical information, ethical messaging, and healthcare disclaimers.

The strategies of medical SEO agencies, content motivated by authority, and specialty-centered positioning providers make trusted experts and transform high-intent search to appointments.

Provider gender preference, prenatal care, reproductive services, and subsequent support are factors that influence patient decisions.

High standards of privacy and safe professional practices protect sensitive health data.

Through specific campaigns by healthcare digital marketing agencies, patient-focused content, and search engine optimization, women health providers are able to increase their visibility and conversion.

Patients seek to book their appointments online with ease, and the availability of technology varies by state.

Regulations of digital healthcare and telehealth provide legal practices that are HIPAA-compliant.

Digital patient journeys are optimized, digital health marketing approaches are applied, and a conversion-based CRO is used to guarantee the highest virtual care uptake.

The availability of the tests, coverage by insurance, transparency in cost, and turnaround time affect patient decisions.

Result handling and processes that are HIPAA-compliant ensure that patient information is protected.

Combined healthcare advertising services, B2B and B2C marketing, and medical advertising agency skills enable labs and imaging centres to make the most out of patient appointments and referrals.

Patients, when receiving mental health care, are concerned about confidentiality, choice of therapist, treatment methods, and insurance coverage as their first priority.

The standards of ethical communication, compliance with privacy rules, and mental health confidentiality are followed strictly.

Wellness clinics gain credibility and loyalty of long-term patients by providing education, marketing the activities of health marketing agencies, and conducting campaigns to engage the communities.

We ensure compliant financial services and fintech marketing protecting your brand and driving results.

Our fintech marketing consultancy reviews financial claims for compliance, preserving credibility and trust in fintech.

Our safe tracking software ensures GDPR and CCPA compliance, providing analytics without compromising user privacy.

Our fintech marketing consultant crafts compliant FinTech messages that are transparent, accountable, and build brand credibility.

Be compliant with financial regulations and privacy standards ,while maintaining high performance. A fintech advertising company guides you through every step.

Focus Areas

In FinTech, visibility equals credibility. Ranking for high-intent financial keywords builds trust, authority, and long-term acquisition channels beyond paid advertising.

Organic SEO is a foundational growth engine for FinTech brands competing in high-cost markets.

FinTech buyers research extensively before choosing a platform. Strong organic visibility ensures your brand appears across the entire decision-making journey.

Getting your profile optimized, scheduling posts, and handling reviews like a pro.

Getting listed on 50+ directories, keeping NAP consistent, and monitoring data.

Service-specific pages with geo-targeted content, schema markup, and local keywords.

Boost credibility with patient reviews: review generation, reputation management, and response templates.

Getting listed on 50+ directories, keeping NAP consistent, and monitoring data.

Service-specific pages with geo-targeted content, schema markup, and local keywords.

All contacts with patients are streamlined to convert into booked appointments and qualified calls

A carefully planned CRO strategy enhances the landing pages, call-to-action effectiveness, the usability of the forms, and the call flow- making sure that the whole patient experience is smooth sailing and conversion-based.

Landing Pages

CTA Testing

Form & Call Flow

Funnel Optimization

Through performance tracking and transparent reporting, we ensure your actions result in 100% revenue generation.

Monthly Visitors

Qualified Leads

Cost Per Lead

Average ROI

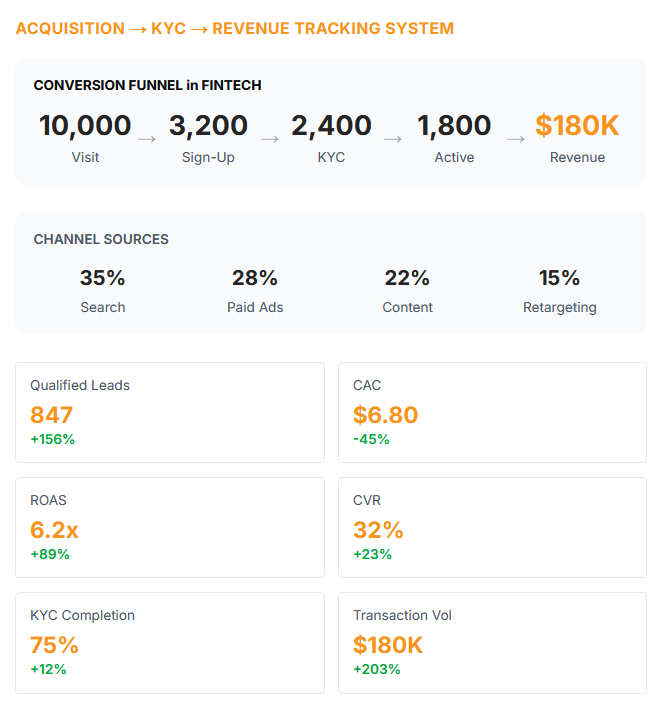

Monitor the number of leads, the price per lead (CPL), and customer acquisition cost (CAC) to maximize marketing expenses. Determine the valuable channels in FinTech.

Study conversion rates of different marketing channels; get insights on which touchpoints are the most effective when it comes to financial product sign-ups and applications.

Determine customer journey drop-offs, especially in the FinTech sales funnel. Enhance customer experience and enhance the conversion process.

Determine the long-term value of customers in the FinTech sector. Evaluate the cumulative financial deals and usage of your services by individual customers.

Clients

Avg RO

Compliance-Aware

Updates

Access

Multi-Channel FinTech Marketing That Drives Qualified Leads

Know your FinTech audience, and adjust products to suit the needs of your audience.

Create a multi-channel Develop a multi-channel approach of SEO, PPC, content, and social in order to generate more leads.

Efficiently streamline each step of the funnel to carry the prospects through the customer life cycle and increase conversions.

Use personalized content to drive solid and reliable conversions and lead-gen in the FinTech industry.

Track performance, campaign optimization, and scale your FinTech marketing with analytics.

We assess your current tracking, pixel health, and technical settings.

Identify high-intent keywords and competitive opportunities in your market

Implement proper analytics, conversion tracking, and attribution systems

Launch integrated campaigns across all channels with coordinated strategy

Continuous testing, refinement, and conversion rate optimization

Regular reporting with strategic scaling of high-performing campaigns

On-demand programs designed to support FinTech startups, scaleups, and enterprise platforms at every growth stage. We, as a fintech seo agency, offer three packages:

Best for Early-Stage FinTech Startups

Built for User & Lead Acquisition

For Enterprise & Multi-Product FinTech Brands

Measurable growth powered by qualified lead data, CPL efficiency, pipeline impact, and real FinTech performance benchmarks.

Increase in Conversion Rate from Paid Campaigns

Reduction in Customer Acquisition Cost

Growth in Sales & Demo Calls

Client Satisfaction Rate

Global FinTech Lending Platform

Increase in Loan Applications from Targeted Marketing Campaigns

Investment Management Firm

Increase in Qualified Leads for Wealth Management Services

FinTech SaaS Company

Reduced Lead Time to Conversion by 35% through Advanced Email Marketing Automation

FinTech campaigns are built to balance compliance, demand generation, and revenue scalability without sacrificing lead quality.

“Lead quality improved significantly while CPL dropped across paid and organic channels.”

Chief Growth Officer, FinTech SaaS

“Campaigns delivered consistent pipeline growth with a strong focus on conversion efficiency and compliance.”

VP of Marketing, Financial Technology Firm

Get answers to common questions

A financial technology marketing agency creates awareness, credibility, quality leads, and scalable expansion by compliant data-driven online campaigns.

A digital marketing agency fintech combines authority with speed in PPC to provide balanced and sustainable acquisition.

A fintech marketing agency prices services based on competition, channels, compliance needs, and growth objectives.

Select an agency with FinTech experience, regulatory understanding, clear KPIs, transparent reporting, and proven performance outcomes.

Yes, a fintech marketing agency for startups enables targeted reach, faster validation, controlled spending, and scalable growth in competitive FinTech markets.

It’s very easy! You can book a free consultation with us on our website or call us directly at +919100915284 or emailing us at contact@ppcroy.com

We, as a top fintech advertising agency and digital marketing company, craft strategies that have been driving qualified leads, trust, and long-term value for FinTech brands.

Fintech Organizations Trust This Team

Average Campaign Performance

30-minute consultation

Speak directly with our fintech digital marketing consultants. We will analyze your business and create a custom growth plan.

Comprehensive analysis

Receive a detailed report on current marketing performance with actionable recommendations to improve ROI.